SoundSelf play is both a very relaxing zone-out self-care moment for me, as well as a deepening tune-up of meditation and breath work. I’ve been starting my day with a cup of coffee and a 15-20 minute SoundSelf session, and often end the day with 40 minute one.

I feel relaxed and clear for the whole day from this, and it is nurturing something deep in me.

SoundSelf is labelling itself as “a technodelic” and that seems like the best way to describe this unique new experience (in the VR domain): somewhere between an old-school Winamp-like sound visualisation and a psychedelic experience.

I highly advised you try it, not in the least as it gives a taste of meditation and/or psychedelics, while keeping legal wherever you are ;-).

A long history with SoundSelf

I’m a huge, long-time fan of SoundSelf: when way back in 2016 I heard about this VR-generated almost-psychedelic software being in its alpha stages, I bought a Kickstarter Oculus Rift CV1 setup just to experience this myself.

From that moment on I’ve been ‘playing’ SoundSelf from that “I’ve got something cool” demo phase, through the kickstarter phase in 2017, to a chance meeting with Robin in 2019 where I got to tell him I bought the Oculus for the experience and he told me he wrote it, to investing in Andromeda Entertainment to bring this to the world, to now the big launch into the wide world in April 2020.

So you could say I’m quite invested and experienced in SoundSelf.

‘Game play’

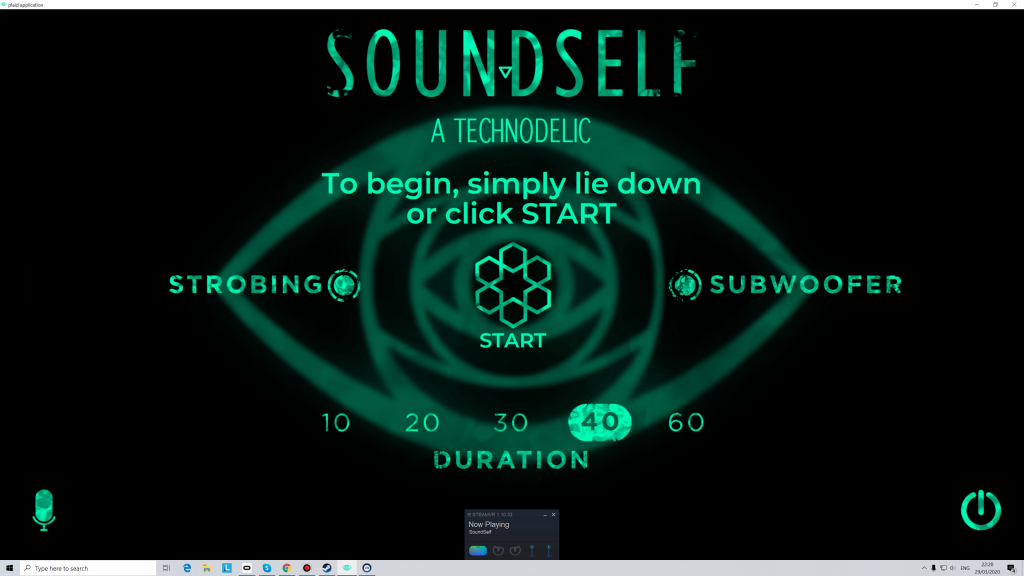

‘Play’ is simple: start SoundSelf, sit or lay back, and tone (drone ‘ooooohhhhhmmmm’).

A SoundSelf session is both a very relaxing zone-out self-care moment for me, as well as a deepening tune-up of meditation and breath work. I’ve been starting my day with a cup of coffee and a 15-20 minute SoundSelf session, and often end the day with 40+ minute one.

I feel relaxed and clear for the whole day from this, and it is nurturing something deep in me.

If I go more meta, games like these are of course a way to enjoy an experience and a story, but also a way nurture and grow something inside me (Robin is saying similar things in interviews). This one is teaching me to take time for myself, to do active breath and toning meditation, and surrender into quiet one-ness.

Psychedelic?

There is research showing SoundSelf helps go into medium altered states [1]. My experience is not a full blown psychedelic experience, but there is definitely a losing my default mode network/ego, and relaxing into the quieting down from the toning and breathing (vagal nerve stimulation).

It definitely is also a good breath exercise.

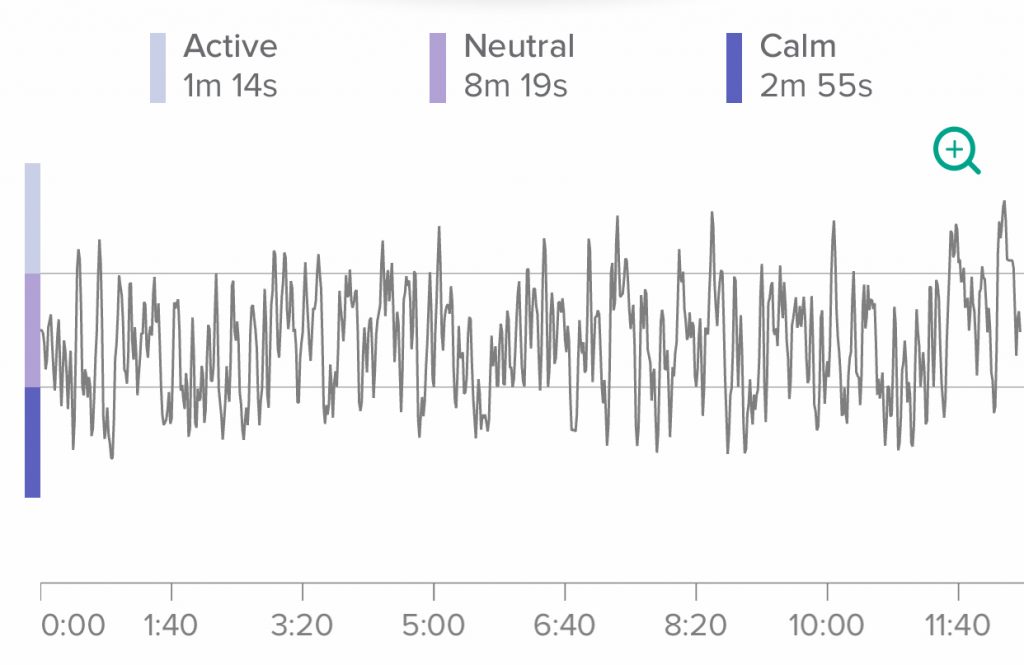

I’ve been making recordings using the Muse as brainwave measurement device, but it is quite a bit of data so I’ll analyse them later.

Quick and dirty measurement using the Muse in normal meditation mode does show way more neutral and calm then in normal state, and obviously more activation than in the Zen no-mind meditation that Muse aims you towards.

Practicalities: VR headset not needed

A frequent question I get from people wanting to experience SoundSelf, is whether you need to have VR goggles?

The answer is simply: no.

But… the more immersive you can make it, the better.

So ideally you set yourself up such that:

- The visuals take up as much as possible of your visual field: use a big screen or projector, sit close to it, have the surrounding visual side be dark and non-distracting.

- You can relax into the sensation, ideally recline back a bit or completely.

- You can feel the base. The audio needs to play on a headset, but a body-shaking subwoofer is a great addition. I have a SubPac that works great for it, but I guess that if you keep it to the low tones, an external subwoofer will work too.

- If you consider getting a VR headset for this (like I did), consider the HTC Vive (or presumably even better because of the bigger field ov view: the Steam Index), over the Oculus Rift, as the newer headsets have less screen door effect and more pixels.

Practicalities: Running on MacBook

The visualisations are fairly CPU and GPU intensive, so even though it works on MacBook, it really needs a recent high-end one.

Currently there is a strange quirk with the microphone and the access control on it by MacOS. This means that if SoundSelf does not ‘hear’ your microphone, try not starting it via Steam but directly start the application. You can tell you are starting it the right application if you see SoundSelf green eye icon, not the blue Steam gear.

On the MacBook you’ll want to disable the ‘strobing’ feature, as the lower frame rate makes it look bad.

(more to come) More here